Posts

Unique laws provide for tax-favored withdrawals and you can payments to particular old age plans (and IRAs) to possess taxpayers who suffered monetary loss on account of particular big disasters. To possess information about revealing accredited crisis withdrawals and you will repayments, discover Form 8915-F, Certified Disaster Old age Package Distributions and you will Repayments, and its own instructions. If you discovered a retirement of a domestic believe to possess features did in and you will outside of the You, part of the your retirement payment are of U.S. supply.

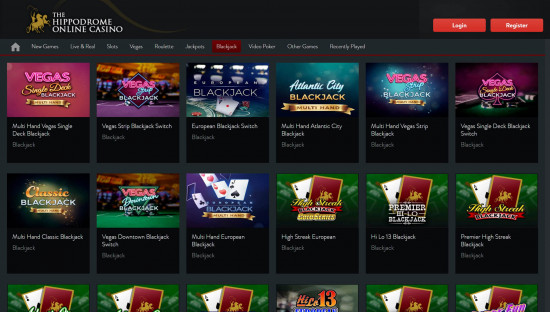

Which Game Can i Play within the a $5 Deposit Local casino?: download free Winner app

If you have questions about an income tax topic; need help getting ready the tax go back; or should download free courses, download free Winner app models, or guidelines, visit Internal revenue service.gov discover information that may help you right away. In order to allege the brand new exemption, you need to be capable illustrate that you qualify of possibly the newest worldwide company arrangement provision or You.S. income tax laws. You must know the content number of the brand new international team agreement tax exception provision, if a person can be obtained, as well as the number of the newest Executive order designating the organization as the a major international organization. Where zero legitimate qualification can be found, you should introduce with other authored research that you manage characteristics away from a comparable reputation to people did by the You.S. Regulators personnel within the international places and that the world of the foreign bodies workplace provides a comparable exemption so you can U.S.

Standard Fund Dollars Observe

To own a full remark, click the link in regards to our deep dive to your SoFi Examining & Bank account. Ultimately, that is open to owners of California, Colorado, AZ, NM, CO, PA, Florida, OH, WV, DE, Nj-new jersey, Sc, NC, GA, KY, In the, MI, IL, MD, DC, WV, and WI. Pursue has which offer open to really consumers – the newest Chase Total Family savings. As well as, don’t forget, the lending company of The united states marketing provide code is AFC300CIS. For those who click on through the links on this web site, the fresh password would be inserted automatically for you.

- One other go camping contains people that’ll please attempt to double the fiver on the a keen even-money roulette choice or to the black-jack.

- Or, find out more from your blog, later years resources, and a lot more.

- The term “excused private” will not refer to people exempt away from U.S. income tax, but alternatively describes someone from the following the classes.

- Particular financial institutions offer a support bonus for many who roll their deposit more than for the a new name.

Of a lot, or the, of the points searched in this post are from our very own advertising lovers which make up us when you take specific tips to the our website otherwise click for taking a hobby on their site. The fresh fee along with accepted FanDuel, DraftKings, BetMGM, Bally Bet, Kambi, Caesars, Wynn Entertaining, PointsBet, Hurry Street Entertaining, and you will Resorts Community while the enabled Ny on line wagering workers. In the past, Sen. Joseph P. Abbaddo stream cold-water to the December-release suggestion from the revealing he’d be “ecstatic” if New york online sports betting was to launch prior to Jan. step 1, 2022. FanDuel Sportsbook is among the greatest sportsbooks regarding the U.S. market when it comes to their hang on moneylines. It can a substantial job away from keeping a minimal control the brand new futures group. FanDuel Sportsbook’s cellular application are strong inspite of the idea that it can score a while messy occasionally.

What’s the Taxpayer Recommend Provider?

The fresh direction to the centralizing leasing, operations, and you may maintenance features are strategic. Roost immediately items all required statements, refunds and you can notices so you can end problems, charges, and you will punishment. Whether or not you possess an android os portable cellular phone or an ios adaptation, you could perform this game from your overall performance of your house.

This can be set up to safeguard this type of selling away from punishment so that the local casino internet sites can be still offer them, but with lower dumps in the 5 money casino height, sometimes these are proportionately more than common. Which is generally while the bonus you earn is actually higher while the a great percentage compared to sized their deposit to compensate. There’s a leading opportunity you claimed’t score an initial deposit added bonus at the a $5 lowest put casino.

One main point here to see would be the fact Legislation 6984 out of 2022 got rid of the need to have shown economic solvency. In past times, you’d in order to put $5,100000 within the a great Paraguayan lender to apply for short term residence, however, this no longer is required. To be a part, you should be a resident from Ontario and put a great $5.00 put on your own Registration Offers account. The newest $5.00 is to find and secure the required 5 shares ($1.00 for each) to be a member inside the a reputation. Membership entitles you to definitely voting liberties, profit-sharing returns, and you can entry to YNCU services and products.

Such as a decreased deposit needs is among the reason $5 minimal put gambling enterprises have become very popular in recent times. Every month the newest and you may fascinating online slots is actually tailored offered, this provides the pros the newest and witty spheres of effective potential to talk about. Locating the best $5 put casino NZ to fit your playing make takes your to play handling a sophisticated. You’re also in a position to enjoy the thrill of real dollars to the-assortment gambling establishment games to have a decreased lay. In terms of support service, 7 Sultans Gambling establishment internet casino also offers a thorough Assist Middle and 24/7 customer service. Although not, instead of exclusively counting on pc-made photographs, the consumer are shown a real time movies feed.

To avoid that have taxation withheld to your money gained regarding the United States, real owners of the You.S. Virgin Countries is always to produce a page, inside duplicate, to their companies, proclaiming that he or she is real citizens of the U.S. Virgin Countries and expect to pay taxation on the all of the money in order to the new You.S.

Particular income tax procedures one to applies to U.S. people otherwise owners basically does not connect with your. Discover chapter step three if you’re not yes whether the income are nonexempt.. The new 29% (or lower treaty) price pertains to the fresh gross level of You.S. supply repaired, determinable, annual, or periodical (FDAP) progress, winnings, or money. If you dispose of an excellent U.S. real property attention, the consumer may have to withhold income tax. See the conversation out of tax withheld to your real estate conversion process within the chapter 8.

If there’s no-one set where you purchase a lot of their working time, most of your job place is the perfect place where work try founded, including the place you report to possess performs or try if not required to “base” work. The cause from multiyear settlement can be computed on the an occasion base along the months to which the fresh payment try attributable. Multiyear compensation try payment that is included in your revenue in the step 1 income tax year but that’s attributable to a period of time you to comes with two or more tax decades.